The young population's aspirations have changed their spending pattern. Financial pressure leading to stress and anxiety has become a common phenomenon.

AGI MONEEY

One Platform, Endless

Possibilities

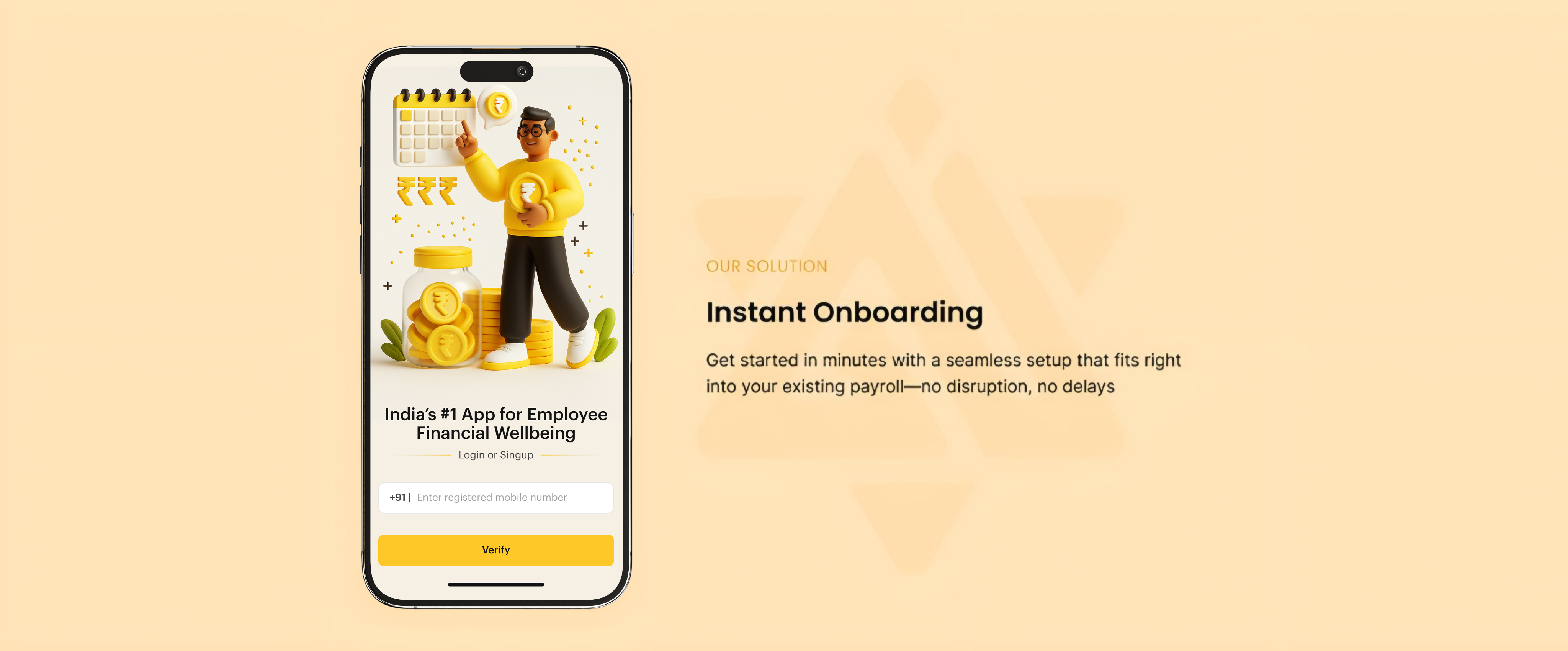

AGI Moneey is India's all-in-one Earned Wage Access and HRMS platform empowering employees with instant salary access while streamlining HR, payroll, and attendance for employers

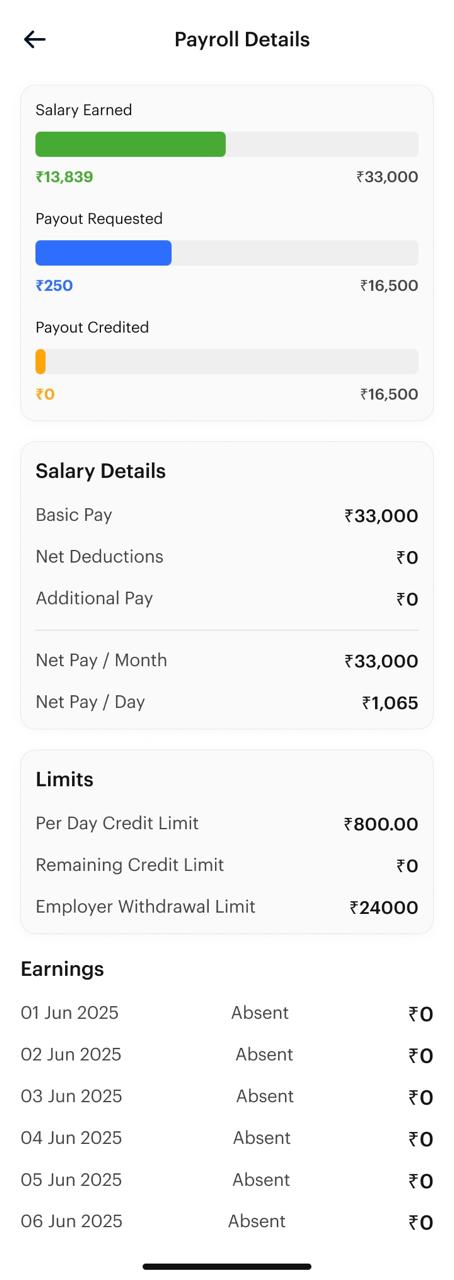

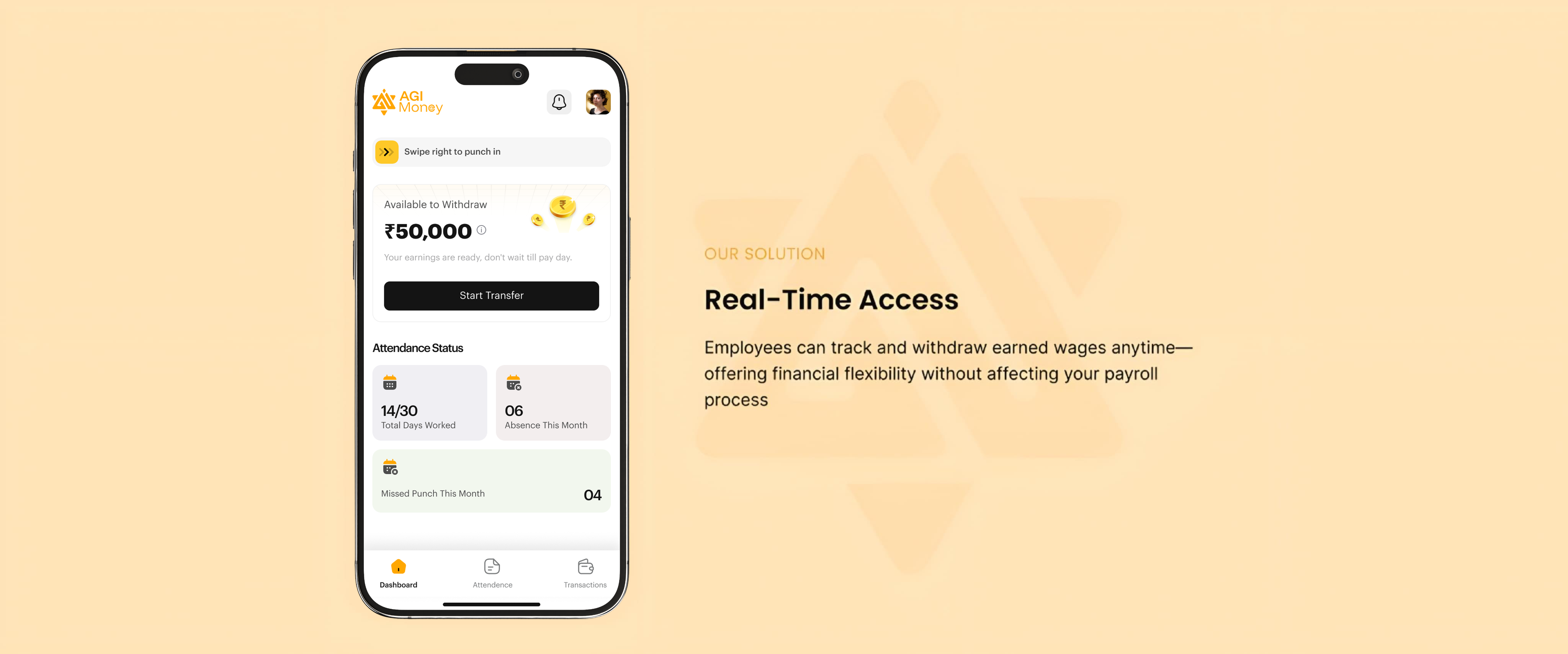

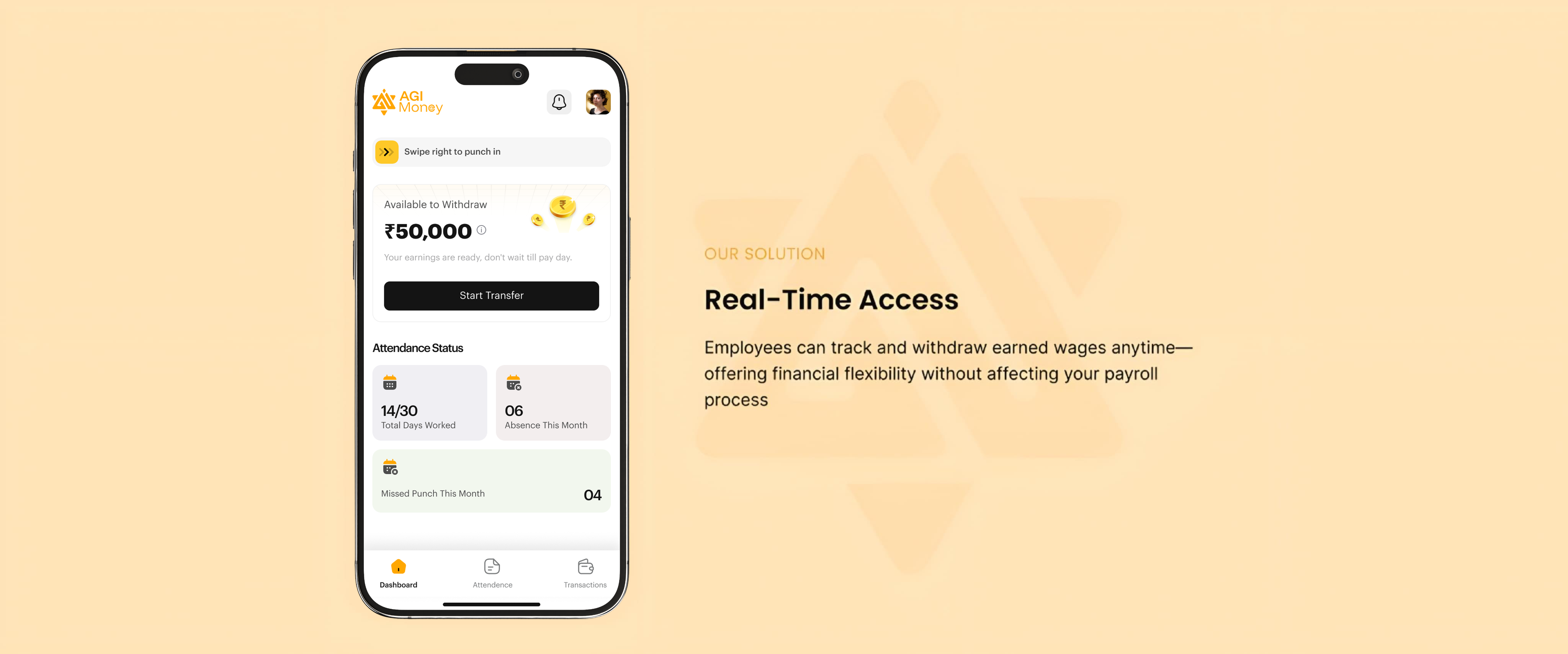

Instant SalaryAccess

Employees can withdraw earned salary anytime—no paperwork, no waiting.

Smart Attendancewith GPS

Geofencing and selfie check-in/out for accurate time tracking and transparency

For Whom This Is

Why Choose AGI Moneey?

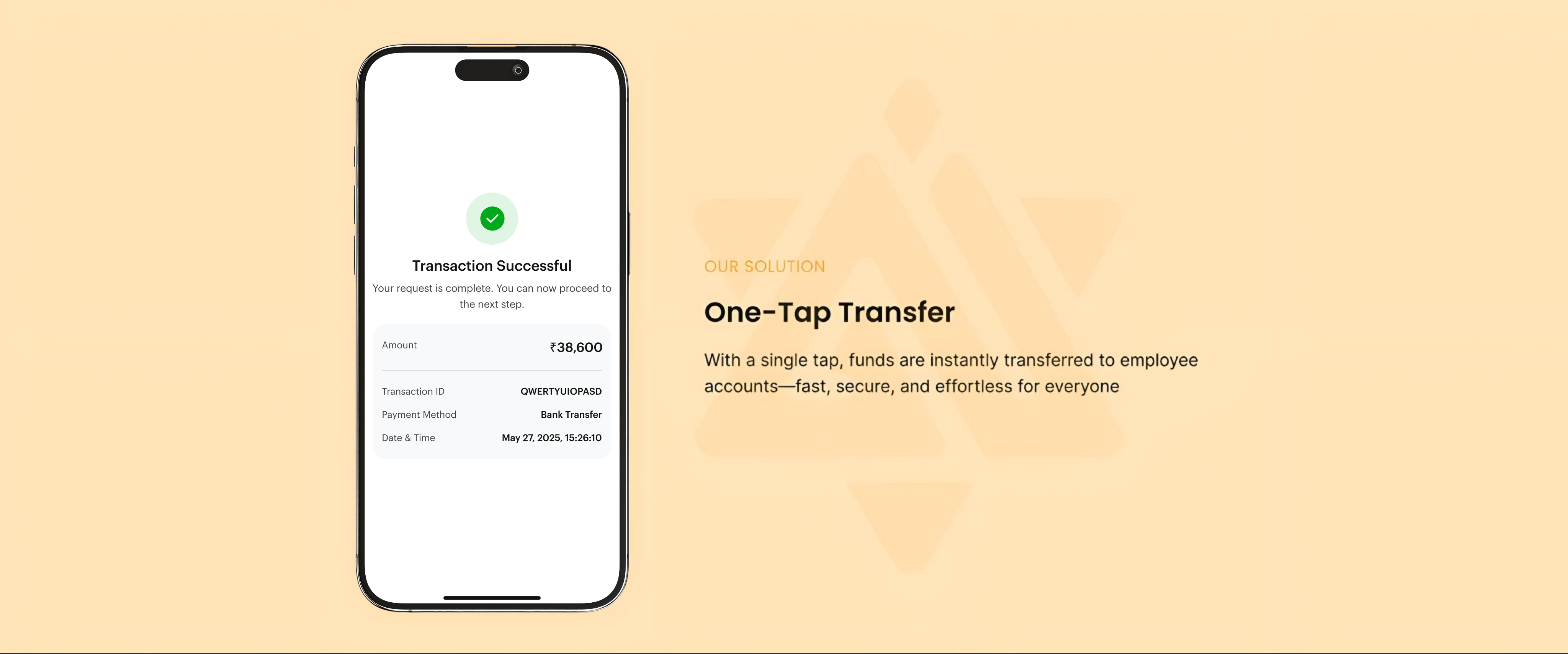

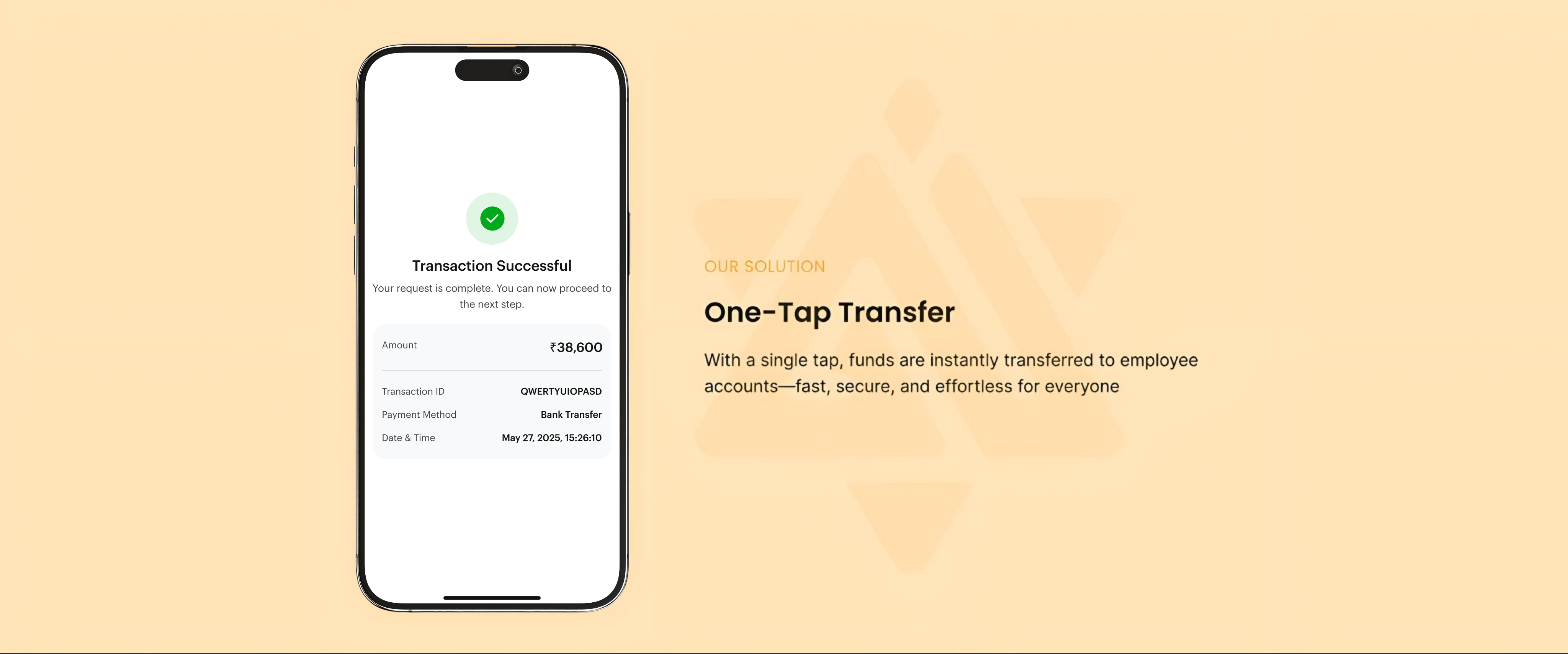

One Tap Access

Enables employee to withdraw salary immediately

No Credit Check

Short-term withdrawal doesn't require any credit check as it is not a loan but an access to earned salary

Zero Interest

This is not a loan and it's an affordable alternative to salary advance

Financial Flexibility

Helps employees to manage mid-month expenses or emergencies

One Tap Access

Enables employee to withdraw salary immediately

No Credit Check

Short-term withdrawal doesn't require any credit check as it is not a loan but an access to earned salary

Zero Interest

This is not a loan and it's an affordable alternative to salary advance

Financial Flexibility

Helps employees to manage mid-month expenses or emergencies

One Tap Access

Enables employee to withdraw salary immediately

No Credit Check

Short-term withdrawal doesn't require any credit check as it is not a loan but an access to earned salary

Zero Interest

This is not a loan and it's an affordable alternative to salary advance

Financial Flexibility

Helps employees to manage mid-month expenses or emergencies

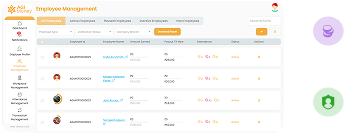

Smarter Payroll, HappierEmployees

From instant wage access to seamless payroll integration, AGI Moneey helps employers deliver a modern financial benefit that teams truly value

Testimonials

What Our Clients Says About Us

Frequently Asked Questions

Do You Have Questions?

We have answers (well most of the times)